Efficient-market hypothesis

From Wikipedia, the free encyclopedia

In financial economics, the efficient-market hypothesis (EMH) states that it is impossible to "beat the market" because stock market efficiency causes existing share prices to always incorporate and reflect all relevant information. According to the EMH, stocks always trade at their fair value on stock exchanges, making it impossible for investors to either purchase undervalued stocks or sell stocks for inflated prices. As such, it should be impossible to outperform the overall market through expert stock selection or market timing, and that the only way an investor can possibly obtain higher returns is by purchasing riskier investments.[1]

The following are the main assumptions for a market to be efficient:

- A large number of investors analyze and value securities for profit.

- New information comes to the market independent from other news and in a random fashion.

- Stock prices adjust quickly to new information.

- Stock prices should reflect all available information.

Financial theories are subjective. In other words, there are no proven laws in finance, but rather ideas that try to explain how the market works.[1]

There are three major versions of the hypothesis: "weak", "semi-strong", and "strong". The weak form of the EMH claims that prices on traded assets (e.g., stocks, bonds, or property) already reflect all past publicly availableinformation. The semi-strong form of the EMH claims both that prices reflect all publicly available information and that prices instantly change to reflect new public information. The strong form of the EMH additionally claims that prices instantly reflect even hidden or "insider" information. Critics have blamed the belief in rational markets for much of the late-2000s financial crisis.[2][3][4] In response, proponents of the hypothesis have stated that market efficiency does not mean having no uncertainty about the future, that market efficiency is a simplification of the world which may not always hold true, and that the market is practically efficient for investment purposes for most individuals.[5]

Contents

[hide]Joint hypothesis problem[edit]

The joint hypothesis problem says that it is never possible to test (sufficiently, to prove or disprove) market efficiency. A test of market efficiency must include some model for how prices may be set efficiently. Then actual prices can be examined to see whether this holds true. Usually this fails and then this supports the case that markets are not efficient. The joint hypothesis problem says that, when this happens, it shows that the model is not complete. There are some factors that are not accounted for. Going further, such factors must have a rational basis, because that is the assumption. No one needs to explain what these factors might be (in fact, that is dangerous because it can be proved wrong), just that they may exist, or no one can prove that they don't.[citation needed]

Historical background[edit]

Possible origins[edit]

Historically, there is a very close link between EMH and the random walk hypothesis and then the Martingale model. The random character of stock market prices was first modelled in 1863 by Jules Regnault, a French broker. Later, it was modeled in 1900 by a French mathematician, Louis Bachelier, in his 1900 PhD thesis, "The Theory of Speculation".[6] His work was largely ignored until the 1950s; however, beginning in the 1930s scattered, independent work corroborated his thesis. A small number of studies indicated that US stock prices and related financial series followed a random walk model.[7] Research by Alfred Cowles in the ’30s and ’40s suggested that professional investors were in general unable to outperform the market.hypothesis is very crucial importance of enabling business in posing riskier investment returns.

Initial formulation[edit]

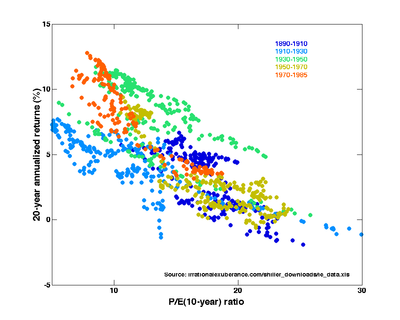

The efficient-market hypothesis was developed by Professor Eugene Fama at the University of Chicago Booth School of Business as an academic concept of study through his published Ph.D. thesis in the early 1960s. It was widely accepted up until the 1990s, when behavioral finance economists, who had been a fringe element, became mainstream.[8] Empirical analyses have consistently found problems with the efficient-market hypothesis, the most consistent being that stocks with low price to earnings (and similarly, low price to cash-flow or book value) outperform other stocks.[9][10] Alternative theories have proposed that cognitive biases cause these inefficiencies, leading investors to purchase overpriced growth stocks rather than value stocks.[8] Although the efficient-market hypothesis has become controversial because substantial and lasting inefficiencies are observed, Beechey et al. (2000) consider that it remains a worthwhile starting point.[11]

Impacts[edit]

The efficient-market hypothesis emerged as a prominent theory in the mid-1960s. Paul Samuelson had begun to circulate Bachelier's work among economists. In 1964 Bachelier's dissertation along with the empirical studies mentioned above were published in an anthology edited by Paul Cootner.[12] In 1965, Eugene Fama published his dissertation arguing for the random walk hypothesis.[13] Also, Samuelson published a proof showing that if the market is efficient prices will show random-walk behavior.[14] This is often cited in support of the efficient-market theory, by the method of affirming the consequent,[15][16] however in that same paper, Samuelson warns against such backward reasoning, saying "From a nonempirical base of axioms you never get empirical results."[17] In 1970, Fama published a review of both the theory and the evidence for the hypothesis. The paper extended and refined the theory, included the definitions for three forms of financial market efficiency: weak, semi-strong and strong (see below).[18]

It has been argued that the stock market is “micro efficient” but not “macro efficient”. The main proponent of this view was Samuelson, who asserted that the EMH is much better suited for individual stocks than it is for the aggregate stock market. Research based on regression and scatter diagrams has strongly supported Samuelson's dictum.[19] This result is also the theoretical justification for the forecasting of broad economic trends, which is provided by a variety of groups including non-profit groups as well as by for-profit private institutions (such as brokerage houses[20] and consulting companies[21]).

Further to this evidence that the UK stock market is weak-form efficient, other studies of capital markets have pointed toward their being semi-strong-form efficient. A study by Khan of the grain futures market indicated semi-strong form efficiency following the release of large trader position information (Khan, 1986). Studies by Firth (1976, 1979, and 1980) in the United Kingdom have compared the share prices existing after a takeover announcement with the bid offer. Firth found that the share prices were fully and instantaneously adjusted to their correct levels, thus concluding that the UK stock market was semi-strong-form efficient. However, the market's ability to efficiently respond to a short term, widely publicized event such as a takeover announcement does not necessarily prove market efficiency related to other more long term, amorphous factors. David Dreman has criticized the evidence provided by this instant "efficient" response, pointing out that an immediate response is not necessarily efficient, and that the long-term performance of the stock in response to certain movements are better indications.

Theoretical background[edit]

Beyond the normal utility maximizing agents, the efficient-market hypothesis requires that agents have rational expectations; that on average the population is correct (even if no one person is) and whenever new relevant information appears, the agents update their expectations appropriately. Note that it is not required that the agents be rational. EMH allows that when faced with new information, some investors may overreact and some may underreact. All that is required by the EMH is that investors' reactions be random and follow a normal distribution pattern so that the net effect on market prices cannot be reliably exploited to make an abnormal profit, especially when considering transaction costs (including commissions and spreads). Thus, any one person can be wrong about the market—indeed, everyone can be—but the market as a whole is always right. There are three common forms in which the efficient-market hypothesis is commonly stated—weak-form efficiency, semi-strong-form efficiency and strong-form efficiency, each of which has different implications for how markets work.

Weak-form efficiency[edit]

In weak-form efficiency, future prices cannot be predicted by analyzing prices from the past. Excess returns cannot be earned in the long run by using investment strategies based on historical share prices or other historical data.Technical analysis techniques will not be able to consistently produce excess returns, though some forms of fundamental analysis may still provide excess returns. Share prices exhibit no serial dependencies, meaning that there are no "patterns" to asset prices. This implies that future price movements are determined entirely by information not contained in the price series. Hence, prices must follow a random walk. This 'soft' EMH does not require that prices remain at or near equilibrium, but only that market participants not be able to systematically profit from market 'inefficiencies'. However, while EMH predicts that all price movement (in the absence of change in fundamental information) is random (i.e., non-trending), many studies have shown a marked tendency for the stock markets to trend over time periods of weeks or longer[22] and that, moreover, there is a positive correlation between degree of trending and length of time period studied (but note that over long time periods, the trending is sinusoidal in appearance).[23] Various explanations for such large and apparently non-random price movements have been promulgated.

There is a vast literature in academic finance dealing with the momentum effect identified by Jegadeesh and Titman.[24][25] Stocks that have performed relatively well (poorly) over the past 3 to 12 months continue to do well (poorly) over the next 3 to 12 months. The momentum strategy is long recent winners and shorts recent losers, and produces positive risk-adjusted average returns. Being simply based on past stock returns, the momentum effect produces strong evidence against weak-form market efficiency,and has been observed in the stock returns of most countries, in industry returns, and in national equity market indices. Moreover, Fama has accepted that momentum is the premier anomaly[26][27]

The problem of algorithmically constructing prices which reflect all available information has been studied extensively in the field of computer science.[28][29]

A novel approach for testing the weak form of the Efficient Market Hypothesis is using quantifers derived from Information Theory. In this line, Zunino et al.[30] found that informational efficiency is related to market size and the stage of development of the economy. Using a similar technique, Bariviera et al.[31] uncover the impact of important economic events on informational efficiency. The methodology proposed by econophysicists Zunino, Bariviera and coauthors is new and alternative to usual econometric techniques, and is able to detect changes in the stochastic and or chaotic underlying dynamics of prices time series.

Semi-strong-form efficiency[edit]

In semi-strong-form efficiency, it is implied that share prices adjust to publicly available new information very rapidly and in an unbiased fashion, such that no excess returns can be earned by trading on that information. Semi-strong-form efficiency implies that neither fundamental analysis nor technical analysis techniques will be able to reliably produce excess returns. To test for semi-strong-form efficiency, the adjustments to previously unknown news must be of a reasonable size and must be instantaneous. To test for this, consistent upward or downward adjustments after the initial change must be looked for. If there are any such adjustments it would suggest that investors had interpreted the information in a biased fashion and hence in an inefficient manner.

Strong-form efficiency[edit]

In strong-form efficiency, share prices reflect all information, public and private, and no one can earn excess returns. If there are legal barriers to private information becoming public, as with insider trading laws, strong-form efficiency is impossible, except in the case where the laws are universally ignored. To test for strong-form efficiency, a market needs to exist where investors cannot consistently earn excess returns over a long period of time. Even if some money managers are consistently observed to beat the market, no refutation even of strong-form efficiency follows: with hundreds of thousands of fund managers worldwide, even a normal distribution of returns (as efficiency predicts) should be expected to produce a few dozen "star" performers.

Criticism and behavioral finance[edit]

Investors and researchers have disputed the efficient-market hypothesis both empirically and theoretically. Behavioral economists attribute the imperfections in financial markets to a combination of cognitive biases such as overconfidence, overreaction, representative bias, information bias, and various other predictable human errors in reasoning and information processing. These have been researched by psychologists such as Daniel Kahneman, Amos Tversky, Richard Thaler, and Paul Slovic. These errors in reasoning lead most investors to avoid value stocks and buy growth stocks at expensive prices, which allow those who reason correctly to profit from bargains in neglected value stocks and the overreacted selling of growth stocks.[citation needed] Investors prefer riskier funds in spring and safer funds in autumn.[34]

Empirical evidence has been mixed, but has generally not supported strong forms of the efficient-market hypothesis[9][10][35] According to Dreman and Berry, in a 1995 paper, low P/E stocks have greater returns.[36] In an earlier paper Dreman also refuted the assertion by Ray Ball that these higher returns could be attributed to higher beta,[37] whose research had been accepted by efficient market theorists as explaining the anomaly[38] in neat accordance with modern portfolio theory.

One can identify "losers" as stocks that have had poor returns over some number of past years. "Winners" would be those stocks that had high returns over a similar period. The main result of one such study is that losers have much higher average returns than winners over the following period of the same number of years.[39] A later study showed that beta (β) cannot account for this difference in average returns.[40] This tendency of returns to reverse over long horizons (i.e., losers become winners) is yet another contradiction of EMH. Losers would have to have much higher betas than winners in order to justify the return difference. The study showed that the beta difference required to save the EMH is just not there.

Economic bubbles and irrational exuberance[edit]

Speculative economic bubbles are an obvious anomaly, in that the market often appears to be driven by buyers operating on escalating market sentiment/irrational exuberance, who take little notice of underlying value. These bubbles are typically followed by an overreaction of frantic selling, allowing shrewd investors to buy stocks at bargain prices. Rational investors have difficulty profiting by shorting irrational bubbles because, in the words of a famous saying attributed toJohn Maynard Keynes, "Markets can stay irrational longer than you can stay solvent."[41] Sudden market crashes as happened on Black Monday in 1987 are mysterious from the perspective of efficient markets, but allowed as a rare statistical event under the weak-form of EMH.

Burton Malkiel has warned that certain emerging markets such as China are not empirically efficient; that the Shanghai and Shenzhen markets, unlike markets in United States, exhibit considerable serial correlation (price trends), non-random walk, and evidence of manipulation.[42]

Behavioral psychology[edit]

Behavioral psychology approaches to stock market trading are among some of the more promising[citation needed] alternatives to EMH (and some[which?] investment strategies seek to exploit exactly such inefficiencies). But Nobel Laureate co-founder of the programme Daniel Kahneman —announced his skepticism of investors beating the market: "They're [investors] just not going to do it [beat the market]. It's just not going to happen."[43] Indeed, defenders of EMH maintain that Behavioral Finance strengthens the case for EMH in that BF highlights biases in individuals and committees and not competitive markets. For example, one prominent finding in Behaviorial Finance is that individuals employ hyperbolic discounting. It is demonstrably true that bonds, mortgages, annuities and other similar financial instruments subject to competitive market forces do not. Any manifestation of hyperbolic discounting in the pricing of these obligations would invitearbitrage thereby quickly eliminating any vestige of individual biases. Similarly, diversification, derivative securities and other hedging strategies assuage if not eliminate potential mispricings from the severe risk-intolerance (loss aversion) of individuals underscored by behavioral finance. On the other hand, economists, behaviorial psychologists and mutual fund managers are drawn from the human population and are therefore subject to the biases that behavioralists showcase. By contrast, the price signals in markets are far less subject to individual biases highlighted by the Behavioral Finance programme. Richard Thaler has started a fund based on his research on cognitive biases. In a 2008 report he identified complexity and herd behavior as central to the global financial crisis of 2008.[44]

Further empirical work has highlighted the impact transaction costs have on the concept of market efficiency, with much evidence suggesting that any anomalies pertaining to market inefficiencies are the result of a cost benefit analysis made by those willing to incur the cost of acquiring the valuable information in order to trade on it. Additionally the concept of liquidity is a critical component to capturing "inefficiencies" in tests for abnormal returns. Any test of this proposition faces the joint hypothesis problem, where it is impossible to ever test for market efficiency, since to do so requires the use of a measuring stick against which abnormal returns are compared —one cannot know if the market is efficient if one does not know if a model correctly stipulates the required rate of return. Consequently, a situation arises where either the asset pricing model is incorrect or the market is inefficient, but one has no way of knowing which is the case.[citation needed]

The performance of stock markets is correlated with the amount of sunshine in the city where the main exchange is located.[45]

A key work on random walk was done in the late 1980s by Profs. Andrew Lo and Craig MacKinlay; they effectively argue that a random walk does not exist, nor ever has.[46] Their paper took almost two years to be accepted by academia and in 1999 they published "A Non-random Walk Down Wall St." which collects their research papers on the topic up to that time.

View of some economists[edit]

Economists Matthew Bishop and Michael Green claim that full acceptance of the hypothesis goes against the thinking of Adam Smith and John Maynard Keynes, who both believed irrational behavior had a real impact on the markets.[47]

Economist John Quiggin has claimed that "Bitcoin is perhaps the finest example of a pure bubble", and that it provides a conclusive refutation of EMH.[48] While other assets used as currency (such as gold, tobacco and U.S. dollars) have value independent of people's willingness to accept them as payment, Quiggin argues that "in the case of Bitcoin there is no source of value whatsoever" and that:

In 2013, Kim Man Lui pointed out that there is difference of performance between experienced and novice traders in a controlled experiment. If the market really walks randomly, there should be no difference between these two kinds of traders. However, traders who are more knowledgeable on technical analysis significantly outperform those who are less knowledgeable.[49]

Tshilidzi Marwala surmised that artificial intelligence influences the applicability of the theory of the efficient market hypothesis in that the more artificial intelligence infused computer traders there are in the markets as traders the more efficient the markets become.[1]

Warren Buffett has also argued against EMH, most notably in his 1984 presentation The Superinvestors of Graham-and-Doddsville, saying the preponderance of value investors among the world's best money managers rebuts the claim of EMH proponents that luck is the reason some investors appear more successful than others.[50] As Malkiel[51] has shown, over the 30 years (to 1996) more than two-thirds of professional portfolio managers have been outperformed by the S&P 500 Index (and, more to the point, there is little correlation between those who outperform in one year and those who outperform in the next.)

Late 2000s financial crisis[edit]

The financial crisis of 2007–08 led to renewed scrutiny and criticism of the hypothesis.[52] Market strategist Jeremy Grantham stated flatly that the EMH was responsible for the current financial crisis, claiming that belief in the hypothesis caused financial leaders to have a "chronic underestimation of the dangers of asset bubbles breaking".[3] Noted financial journalist Roger Lowenstein blasted the theory, declaring "The upside of the current Great Recession is that it could drive a stake through the heart of the academic nostrum known as the efficient-market hypothesis."[4] Former Federal Reserve chairman Paul Volcker chimed in, saying it's "clear that among the causes of the recent financial crisis was an unjustified faith in rational expectations [and] market efficiencies."[53] "By 2007–2009, you had to be a fanatic to believe in the literal truth of the EMH", noted one financial analyst.[54]

At the International Organization of Securities Commissions annual conference, held in June 2009, the hypothesis took center stage. Martin Wolf, the chief economics commentator for the Financial Times, dismissed the hypothesis as being a useless way to examine how markets function in reality. Paul McCulley, managing director of PIMCO, was less extreme in his criticism, saying that the hypothesis had not failed, but was "seriously flawed" in its neglect of human nature.[55][56]

The financial crisis led Richard Posner, a prominent judge, University of Chicago law professor, and innovator in the field of Law and Economics, to back away from the hypothesis and express some degree of belief in Keynesian economics. Posner accused some of his Chicago School colleagues of being "asleep at the switch", saying that "the movement to deregulate the financial industry went too far by exaggerating the resilience—the self healing powers—of laissez-faire capitalism."[57] Others, such as Fama, said that the hypothesis held up well during the crisis and that the markets were a casualty of the recession, not the cause of it. Despite this, Fama has conceded that "poorly informed investors could theoretically lead the market astray" and that stock prices could become "somewhat irrational" as a result.[58]

Critics have suggested that financial institutions and corporations have been able to reduce the efficiency of financial markets by creating private information and reducing the accuracy of conventional disclosures, and by developing new and complex products which are challenging for most market participants to evaluate and correctly price.[59][60]

Efficient markets applied in securities class action litigation[edit]

The theory of efficient markets has been practically applied in the field of Securities Class Action Litigation. Efficient market theory, in conjunction with "Fraud on the Market Theory," has been used in Securities Class Action Litigation to both justify and as mechanism for the calculation of damages.[61] In the Supreme Court Case, Halliburton v. Erica P. John Fund, U.S. Supreme Court, No. 13-317, the use of efficient market theory in supporting securities class action litigation was affirmed. Supreme Court Justice Roberts wrote that "the court’s ruling was consistent with the ruling in "Basic" because it allows“ direct evidence when such evidence is available” instead of relying exclusively on the efficient markets theory." [62]

No comments :

Post a Comment

Note: only a member of this blog may post a comment.