The process of buying a vehicle is a complex, highly involved consumer decision (Solomon 2014). A vehicle is one of the most expensive purchases made by individuals or households, often equal to many months or even years of income, and will last for many years. As a result, consumers perceive the decision to be a relatively risky one and will strive to ensure a “safe” decision so that they are not stuck with a poor purchase choice for years to come. In general, consumers want vehicles that are affordable, safe, reliable, and comfortable for travel and meet many practical needs, such as getting them to work, school, stores, and recreation and vacation areas. Some also want vehicles to meet their psychosocial needs; for example, vehicles can serve as status symbols that represent one’s success or self-image. For all these reasons, consumers generally will undertake lengthy research into their options to ensure a good choice that satisfies all their various needs.

Plug-in electric vehicles (PEVs) must compete effectively with internal-combustion engine (ICE) vehicles in meeting consumer needs. However, PEVs, many of which are in their first generation of deployment, add complexity and uncertainty to the consumer’s multistep and potentially time-consuming process of purchasing a vehicle. Under conditions of uncertainty and perceived risk, consumers tend to gravitate to the known and familiar. That observation is well-documented in the literature, particularly in Daniel Kahneman’s (2013) work, Thinking Fast and Slow, which spurred much recent work in behavioral economics. Because innovative products require a higher degree of learning than existing products, the effort customers must put into the decision process is greater than for more familiar products. To unseat incumbent technologies, the new technology must offer advantages and benefits sufficient to offset any price differential and the perceived risk and uncertainty of purchasing an innovation (Aggarwal et al. 1998). Thus, the committee emphasizes that consumer considerations loom large for the deployment of PEVs in the nation’s transportation mix, and understanding consumer perceptions, knowledge, and behavior are key to crafting viable strategies for successful commercialization of PEVs.

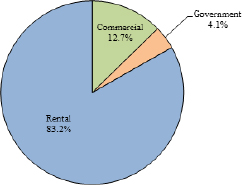

This chapter begins with a general discussion of models of adoption and diffusion of innovation. It presents evidence on how new technologies are adopted by various categories of customers and discusses the factors that affect the pace of adoption and diffusion of a new technology through society. Next, the chapter discusses consumer demographics and evaluates the implications of that information and other factors that affect adoption and diffusion of PEVs. The chapter then reviews what motivates the purchases of mainstream consumers and possible barriers for their adoption of PEVs. Next, the chapter reviews strategies for addressing consumer concerns and describes government efforts to familiarize the public with PEVs. Throughout the chapter, at the conclusions of the various sections, the committee highlights relevant findings. Recommendations for addressing consumer perceptions (or misperceptions) and barriers to adoption are presented in a section dedicated to overcoming the challenges. The committee notes that the chapter focuses primarily on private (individual) new vehicle buyers, who are responsible for about 80 percent of all new vehicle purchases. Fleet sales, which average 20-22 percent of the U.S. market (Automotive Fleet 2013), are addressed at the conclusion of this chapter.

Models for the Adoption of Innovative Products

Developers of new technologies generally, and of PEVs specifically, face challenges in developing a market and motivating consumers to purchase or use their products (Mohr et al. 2010). Incumbent technologies—in this case, ICE vehicles—can be difficult to unseat; they have years of production and design experience, which make their production costs lower than those of emerging technologies and thus more affordable. In addition, ICE vehicle technology is continuously improving; many of these improvements, which are being made to meet tighter fuel economy and greenhouse gas emission standards (EPA/NHTSA 2012), are described in the NRC report Transitions to Alternative Vehicles and

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

Fuels (NRC 2013a). The necessary infrastructure—including dealerships, service stations, roadside assistance, and the ubiquity of over 100,000 gasoline stations across the United States (U.S. Census Bureau 2012)—is also well developed. Consumers know the attributes and features to compare to evaluate their ICE-vehicle choices, and they are accustomed to buying, driving, and fueling these vehicles. Indeed, one of the main challenges to PEV adoption is how accustomed people are to ICE vehicles.

Traditional consumer-adoption models predict the diffusion of new innovations through society (Parasuraman and Colby 2001; Rogers 2003; Moore 2014). The models are well established and empirically validated across many product categories (Sultan et al. 1990) and can help in understanding the consumer purchase decision and market development process for PEVs. As stated in Chapter 1, PEV sales reached about 0.76 percent of the U.S. market in 2014 (Cobb 2015). To put that in perspective, it took 13 years for hybrid electric vehicles (HEVs) to exceed 3 percent of annual new light-duty vehicle sales in the United States (Cobb 2013).1

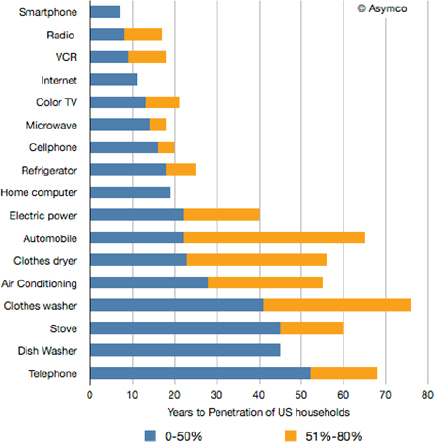

To compare various rates of market penetration, Figure 3-1 shows the consumer technologies with the fastest growth rates. As the figure shows, new products can take many years to be adopted by a large percentage of the consumers in a market. For example, consider that the microwave—a relatively inexpensive and practical item with no complicated infrastructure needs—took 15 years to reach just 50 percent market penetration. Consumers did not have experience with microwave ovens nor did they initially see the value or usefulness of such a product; its means of cooking was not understood, and it did a poor job of “baking” compared with conventional ovens. Indeed, calling the microwave an “oven” was probably an error, as that term confused consumers about the microwave’s functions. Initial uses of the microwave were to heat water, thaw and heat frozen food, and reheat leftovers—few of these tasks had much to do with how conventional ovens were used. It took many years to educate the consumer about exactly what a microwave could do. Consumer knowledge, societal lifestyle changes, and lower prices due to volume production over decades resulted in microwaves being a primary appliance in the household, nearly 20 full years after they were first introduced.

One insight is that adoption and diffusion of new innovations can be a long-term, complicated process that is especially slow for products that cost tens of thousands of dollars and where consumers have questions about infrastructure availability, resale value, and other variables. A further complication can be the innovation ecosystem, which includes all elements of the total customer solution. For PEVs, the innovation ecosystem includes not only the vehicle but also the charging stations (whether at home, at work, or in public spaces) and the necessary permitting and installation, availability of roadside assistance, and other ownership or main-

FIGURE 3-1 Years needed for fastest growing consumer technologies to achieve penetration (0-50 percent or 51-80 percent). SOURCE: Dediu (2012) © Horace Dediu, Asymco.

_____________

1 More information on vehicle technologies, emissions, and fuel economy trends is available in the EPA Trends Report (EPA 2014).

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

tenance concerns. Accordingly, the innovation ecosystem for PEVs has its own transition barriers that must be addressed for maximum market penetration to occur. Adner (2006) suggests that wide-scale deployment of new technologies is a function of three aspects of infrastructure development: (1) product technology—for example, viable, low-cost battery technology; (2) downstream infrastructure—for example, dealers, repair facilities, emergency roadside services, and battery recycling options; and (3) complementary infrastructure—for example, charging stations (whether residential, workplace, or public), knowledgeable electricians, and amenable zoning and permitting at the municipal level.

Adner’s work on innovation ecosystems provides guidance for how industry stakeholders might make investment decisions to encourage adoption of new technologies. For example, if infrastructure is identified as the critical bottleneck that affects customer adoption and use, industry stakeholders might decide to invest more in infrastructure development than in the product itself. Indeed, Japan has recognized that need and has instituted a major initiative to build an extensive charging infrastructure to instill range confidence and ensure a safety net for limited-range battery electric vehicle (BEV) drivers (METI 2010). Brown et al. (2010) also emphasized the importance of supporting infrastructure development and advocated for standardization of codes, training, and other aspects of infrastructure to facilitate the PEV market.

Given the complexity of the innovation ecosystem, mainstream consumers typically are unwilling to undertake what might be perceived as a risky purchase until all elements of the requisite infrastructure are in place (Moore 2014). Indeed, if all aspects of the innovation ecosystem are not ready when consumers are making purchase decisions, industry adoption rates can be substantially lower than initial expectations.

Adoption and diffusion models provide insight into what might be considered realistic expectations about market penetration rates. Given that about 16 million new vehicles are purchased each year, it would take at least 16 years to convert the total U.S. fleet of 250 million passenger vehicles and light-duty trucks if only PEVs were sold. In addition, not all households exhibit the demographic and lifestyle traits that make PEVs a viable purchase option. Specifically, when estimating the total addressable market for PEV sales, one must consider what percentage of the total population would find PEVs practical for their travel patterns and needs. A nationally representative telephone survey of adult vehicle owners found that 42 percent of drivers—45 million households—meet the basic criteria2necessary to use a plug-in hybrid electric vehicle (PHEV), such as the Chevrolet Volt, for their transportation needs with few, if any, changes in behavior (Consumers Union and the Union of Concerned Scientists 2013). Of the drivers who could use a PHEV, 60 percent also fit the profile of those who could use a limited-range BEV, such as the Nissan Leaf, without major life changes.

Therefore, market adoption and diffusion of PEVs, which are expensive, infrequently purchased, long-lasting products with a complicated industry ecosystem, will be a slow process that will take decades. That insight is corroborated by the data presented early in Chapter 1 regarding early-market growth rates and market shares of PEVs.

Finding: Market penetration for new technology—particularly expensive, infrequently purchased, long-lasting innovations with a complicated ecosystem—is typically a slow process that takes 10-15 years or more to achieve even nominal penetration.

Finding: Market penetration rates are a function not only of the product being purchased but also of the entire industry ecosystem. Hence, product technologies, downstream infrastructure, and complementary infrastructure all must be attended to simultaneously during the development process.

Finding: PEVs on the market as of 2014 are not a viable option for all vehicle owners; rather, perhaps only about 40 percent of U.S. households exhibit lifestyles amenable to owning and operating a PEV.

Consumer Diffusion Models and Market Segments

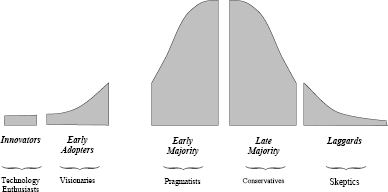

Diffusion models categorize consumers (adopters) on the basis of their propensity to adopt new technologies and identify the factors that facilitate adoption and diffusion. Figure 3-2 illustrates that markets for innovation comprise five distinct categories of adopters; Table 3-1describes each category in terms of demographic and psychographic characteristics and buying motivations. Psychographics refer to values and lifestyles of consumers and can be determined empirically through market research on their activities, attitudes, interests, and opinions (Kahle and Chiagorous 1997; Wells 2011). Although demographics can explain who is buying particular types of products, psychographics are more likely to explain why customers buy; therefore, psychographics generally are more useful than demographics in understanding customer decisions. Major factors that affect diffusion include communication (word-of-mouth) between consumers and social networks (Mahajan et al. 1990).

Demographic Traits of Buyers of Plug-in Electric Vehicles

Demographic traits of PEV buyers are compared with those of ICE-vehicle buyers in Table 3-2, which shows that many characteristics of PEV buyers correspond to the traits

_____________

2 Basic criteria for PHEVs independent of pricing included access to parking and an electric outlet at home or work, seating capacity for no more than four occupants, and no hauling or towing capability. A BEV was considered suitable not only when the PHEV criteria were met but also when the maximum weekday driving distance was less than 60 miles and other household vehicles were available if weekend driving frequently exceeded the current BEV range (Consumers Union and the Union of Concerned Scientists 2013).

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

FIGURE 3-2 Distribution of adopter categories. Labels reflect orientation to technology. SOURCE: Moore (2014) ©1991 by Geoffrey A. Moore. Reprinted by permission of HarperCollins Publishers.

| Category | Description |

| Innovators or enthusiasts | Are technology enthusiasts or lovers. |

Are willing to buy early release versions even if product quality or reliability are not yet proven or established.

| |

Want to work with developers and infrastructure providers to improve new products, a source of pride in their own techno-intelligence.

| |

Are important segments for endorsement about viability of the new innovation category.

| |

Are not a large enough market segment to be a long-lived or significant source of revenue.

| |

Early Adopters or Visionaries

|

Are less concerned about price and more motivated by psychosocial benefits, such as visibility of their purchase in their peer group.

|

Are more affluent, cosmopolitan, and, typically, younger than other categories.

| |

Are willing and motivated to address early market development problems, including service and infrastructure challenges, which when solved, become a source of pride.

| |

Are generally considering or comparing purchases not within the product category (for example, with a different vehicle make or model) but with some other major purchase.

| |

Early Majority or Pragmatists

|

Are very concerned about value (benefits received relative to price paid).

|

Want to evaluate several different models or options within the product category.

| |

Are willing to purchase only when all elements of the requisite infrastructure are in place.

| |

Want a hassle-free solution that performs as promised.

| |

Are not willing to tolerate anxiety or doubt.

| |

Are first sizable segment of the market by volume.

| |

Late Majority or Conservatives

|

Tend to buy when there are a plethora of models and choices in the market and when prices have substantially decreased.

|

Laggards or skeptics

|

Would prefer not to buy anything designated as a new technology.

|

Do so only when they can no longer avoid doing so.

|

NOTE: Early and late are relative terms based on the time it takes to adopt.

of early market adopters. PEV buyers had a median income of nearly $128,000 to $148,000 whereas ICE-vehicle buyers had a median income of about $83,000 (Strategic Vision 2014). By way of comparison, HEV buyers had a median household income of $90,204, and the average median U.S. household income was $51,017 (U.S. Census Bureau 2013a). Consistent with traits of early adopters, PEV buyers were better educated than ICE-vehicle buyers.

Table 3-3 lists demographic data for purchasers of a vehicle from each category of PEV as defined in Chapter 2 (long-range BEV, limited-range BEV, range-extended PHEV, and minimal PHEV) compared with data for all new-vehicle buyers. The table shows that of the four types of PEVs, Tesla Model S buyers are primarily men who have higher incomes, paid cash, and did not seriously consider purchasing another vehicle, whereas Nissan Leaf buyers are younger with larger household sizes. Chevrolet Volt buyers exhibit lower educational levels than other PEV buyers. Toyota Plug-in Prius buyers have a higher percent of female buyers. Finally, PEV buyers who considered other models of PEVs in their purchase process reported that the vehicle that they most seriously considered was the Chevrolet Volt.

The data presented in Table 3-3 also show that leasing rates vary by PEV model. The Nissan Leaf and Chevrolet Volt have higher lease rates than the Toyota Plug-in Prius or Tesla Model S (Strategic Vision 2014). Furthermore, data from the California Plug-in Electric Vehicle Survey indicate that PEVs are leased at a rate of 28.8 percent in California,

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

| Characteristic | BEV Buyer | PHEV Buyer | ICE-Vehicle Buyer | |

| Gender | 77% male | 70% male | 60% male | |

| Marital status | 81% married | 78% married | 66% married | |

| Average age | 48 years | 52 years | 52 years | |

| Education | 86% college graduate | 77% college graduate | 59% college graduate | |

| Occupation | 42% professional | 37% professional | 25% professional | |

| Median household income | $148,158 | $127,696 | $83,166 | |

| Number of respondents | 3,556 | 1,000 | 186,662 | |

NOTE: BEV, battery electric vehicle; ICE, internal-combustion engine; PHEV, plug-in hybrid electric vehicle.

SOURCE: Strategic Vision New Vehicle Experience Study of Vehicle Registrants, October 2013-June 2014.

| Characteristic | All New-Vehicle Buyers | Tesla Model S | Nissan Leaf | Chevrolet Volt | Toyota Prius Plug-in |

| Gender (M/F) | 61/39 | 82/18 | 77/23 | 74/26 | 66/34 |

| Married or partnered | 71 | 83 | 87 | 82 | 76 |

| Age 50+ | 56 | 68 | 37 | 61 | 39 |

| Household size of 1 or 2 | 58 | 56 | 35 | 53 | 46 |

| College grad or more | 59 | 87 | 86 | 77 | 83 |

| Income +$100K | 40 | 88 | 66 | 63 | 62 |

| Caucasian | 79 | 86 | 70 | 82 | 56 |

| Purchased/leased | 78/22 | 95/5 | 14/86 | 56/44 | 68/32 |

| Paid cash | 14 | 36 | 5 | 12 | 2 |

| Received special financial incentives | 64 | 24 | 76 | 73 | 88 |

| Did not seriously consider any other vehicle | NA | 62 | 50 | 42 | 48 |

| Seriously considered other models | NA | Chevrolet Volt (1%) | Chevrolet Volt (10%) | Toyota Plug-in Prius (5%) | Chevrolet Volt (8%) |

| Number of respondents | 237,235 | 285 | 2,257 | 556 | 169 |

a Entries are provided as percent of respondents.

SOURCE: Strategic Vision New Vehicle Experience Study of Vehicle Registrants, October 2013-June 2014.

greater than the overall lease rate for light-duty vehicles in the United States (Rai and Nath 2014; Tal et al. 2013). Although many consumers have never leased a vehicle and are therefore unfamiliar with the process, leasing a PEV removes the risk to the consumer that is associated with unknown resale value, battery decay, and rapid technology changes. Moreover, leasing agencies are able to incorporate the federal tax incentives into a shorter period of time. As a result, attractive leasing deals have positively affected PEV sales (Loveday 2013a). Whether leases appeal differentially to early adopters or mainstream customers is unknown.

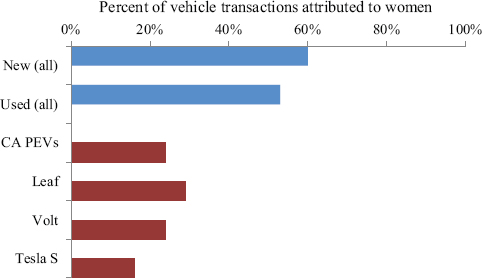

To date, male buyers dominate the PEV market. Figure 3-3 shows that although women make between 50 and 60 percent of vehicle purchases generally (the top two bars in the figure represent U.S. data on all vehicles), their involvement in PEV purchases ranges between only 15 and 30 percent (the bottom four bars in the figure represent data on California PEV buyers or lessees only) (Caperello et al. 2014). The authors’ detailed interviews and focus groups find that men treat PEV purchases as “projects”—a classic feature of early market adopters—whereas women in the study expressed more practical concerns and did not want to experiment, a buying trait more typical of mainstream adopters. Hence, the gender data also are consistent with differences between early adopters and mainstream adopters.

Finding: PEVs to date have been sold primarily to customers in the early adopter segment of the marketplace whose

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

FIGURE 3-3 Women’s rate of participation in the markets for all vehicles and for PEVs. The figure shows that women’s participation in vehicle purchases is much lower for PEVs than for vehicles as a whole. Data in blue represent the entire used and new-vehicle market for the entire United States. Data in red reflect California PEV purchasers. NOTE: PEV, plug-in electric vehicle. SOURCE: Image courtesy of Kenneth S. Kurani, University of California, Davis, Institute of Transportation. Data compiled from NBCUniversal, Center for Sustainable Energy, California Air Resources Board Clean Vehicle Rebate Project, and EV Consumer Survey Dashboard.

traits and buying motives are different from those of the mainstream market segment.

Selecting a Beachhead

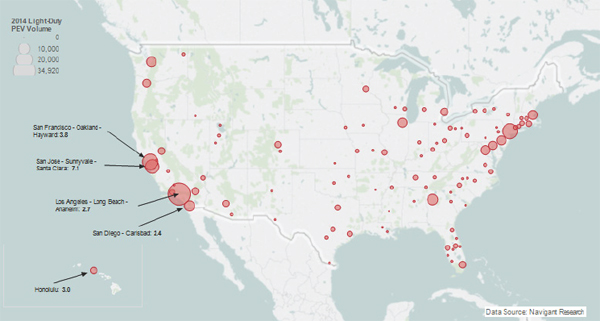

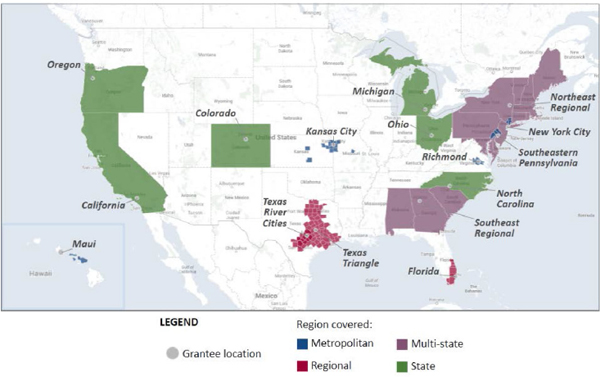

Diffusion is a social and geographic process; at any point in time, diffusion in one region of a large country can be ahead of diffusion in another, as is illustrated in Figure 3-4, which shows the variation in PEV deployment across the United States and provides the projected cumulative PEV volume in 2014 for the 100 largest urban areas. PEVs tend to be sold in states and municipalities where both the demographic and psychographic profiles of residents are consistent with those of the early adopter category; these areas also tend to have a positive regulatory climate for PEVs. California is one such area and has a long history of strong sales for new vehicle technologies. It has the highest proportion of HEVs in the United States, and the Toyota Prius hybrid was the best-selling vehicle in California in 2012 and 2013.

To ensure that new technologies succeed with mainstream consumers, Moore (2014) suggests selecting a “beachhead,” a narrow market segment of consumers for whom the new technology offers “a compelling reason to buy.” That approach is in contrast to conventional thinking that a broad mass market is desirable. The logic behind a beachhead is that, by offering a compelling value proposition specifically targeted to meet the needs of a narrow subset of consumers, the technology stands a greater chance of dominance in a key market segment. Then, the momentum gained through dominance in the initial beachhead can be used more efficiently and effectively to drive sales in related, adjacent segments. For example, word-of-mouth communication is easier and more effective between adjacent market segments (related geographically, by common lifestyles, or by common professional circles) because people will find communicating with others who have similar traits more credible and relevant than with those who have dissimilar traits. Thus, rather than attempting to succeed in the broad mass market, providers of new and complex technologies find it advantageous to focus on a narrow segment of consumers for whom the innovation offers a compelling reason to buy. Success in that initial segment then can be leveraged powerfully in adjacent segments.

For the PEV market, a beachhead approach logically would focus on key geographic regions or regional corridors where momentum has already been established; infrastructure is more readily available; word-of-mouth between neighbors, friends, and co-workers can occur more readily; where there is greater availability of PEV makes and models; and where gasoline is expensive or electricity is cheap. As one might expect, California is a particularly attractive market; it accounts for over one-third of annual PEV sales in the United States, and sales of PEVs in California at the close of 2014 comprised 3.2 percent of new light-duty vehicle sales and 5.2 percent of new passenger vehicles (CNCDA 2015). It also has a supportive regulatory environment with its zero-emission-vehicle (ZEV) mandate, which has been a prime contributor to the availability of PEV models in California. States that have agreed to implement the multistate ZEV

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

FIGURE 3-4 Projected 2014 light-duty PEV volume in the 100 largest MSAs. Dot size is proportional to the projected total PEV volume in that MSA in 2014. It can be seen that large numbers of vehicles are located in Los Angeles, the San Francisco Bay Area, New York, San Diego, Seattle, and Atlanta. As noted in the figure, San Jose, San Francisco, Honolulu, Los Angeles, and San Diego have the largest per capita concentrations of PEVs (volume projected for 2014 per 1,000 people based on 2012 census projections). NOTE: MSA, metropolitan statistical areas; PEV, plug-in electric vehicle. SOURCE: Data courtesy of Navigant Research in Shepard and Gartner (2014).

action plan (modeled after California’s ZEV mandate) and that have greater availability of PEV models are also favorable places for the beachhead approach. They include Connecticut, Maryland, Massachusetts, New Jersey, New York, Oregon, and Rhode Island.3 Places where there is clean and low-cost hydroelectric power are also favorable locales for the beachhead approach. One such example is Washington state, which has higher PEV per capita sales than California.

One final segment that could constitute a favorable PEV market is the multiple-vehicle household. Most households have more than one vehicle. At the national level, of the roughly 75 million owner-occupied housing units, 3.4 percent have no vehicle, 26.7 percent have one vehicle, 43.8 percent have two vehicles, and 26.1 percent have three or more vehicles (U.S. Census Bureau 2013b). Having multiple vehicles offers the opportunity to choose among vehicles that have different utilities. For example, a multiple-vehicle household might be able to mitigate the challenges of owning a limited-range BEV if it also owns a PHEV or an ICE vehicle that can be used for long-distance trips. Many households that have multiple vehicles, however, might not be able to replace all their vehicles with PEVs because all the parking spots might not have access to charging infrastructure.

Finding: The PEV market is characterized by strong regional patterns that reflect certain key demographics, values, and lifestyle preferences and have favorable regulatory environments for PEVs.

Finding: Initial beachheads for PEV deployment are specific geographic areas, such as California, that have expensive gasoline; key demographics, values, and lifestyles; a regulatory environment favorable to PEVs; a variety of PEV makes and models available; and existing infrastructure or an ability to readily deploy such infrastructure.

Driving Characteristics and Needs of the Mainstream Consumer

As discussed, selecting a beachhead plants the seeds for the diffusion and adoption of PEVs, but PEVs will need to meet more consumer needs to gain greater market share or become widely adopted. To understand what mainstream

_____________

3 Information on model availability by state was provided by representatives of vehicle manufacturers. Sources were Brian Brock-man, Nissan, September 8, 2014; William Chernicoff, Toyota, August 22, 2014; Kevin Kelly, Joe LaMuraglia, and Shad Blanch, GM, August 22, 2014; James Kliesch, Honda, September 2, 2014; Nancy Homeister, Ford, September 2, 2014; and Dan Irvin, Mitsubishi, September 10, 2014.

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

consumers might want, it is important to consider how people use vehicles and how those driving habits intersect with the four classes of PEVs defined in Chapter 2. As of 2013, there were more than 233 million light-duty vehicles registered in the United States, each traveling on average 11,346 miles per year (FHWA 2015). The Federal Highway Administration provides more detailed information about household trips that might help to determine whether consumers would be interested in purchasing and using PEVs. In the most recent data from 2009, households reported an average of 3.02 trips per vehicle per day and 28.97 miles per day per vehicle and an average vehicle trip length of 9.72 miles (FHWA 2011). Changing trends in vehicle ownership and use are discussed in greater detail in the next section.

Although averages provide some important information about how people use their vehicles, there is substantial variability in use among drivers and vehicle type and over time (for example, from one day to the next), so that average use might not fully capture consumer needs over the life of the vehicle. For example, the National Household Travel Survey shows that trips of fewer than 10 miles constituted 71 percent of trips and accounted for 25 percent of miles traveled. Commuting is a common routine trip that averages lengths of 6 miles and represents 27.8 percent of miles. Routine trips are important to consider because they represent an opportunity to electrify miles and maximize the value proposition for PEVs. Long trips (over 100 miles) represented less than 1 percent of trips but 16 percent of miles traveled (FHWA 2011). As noted in Chapter 2, long trips are an issue for BEVs because trips that exceed the all-electric range become inconvenient.

Mainstream consumers consider what kinds of trips they need to complete when purchasing (and using) a vehicle. Those considerations will affect their views on the utility of the vehicle. Many consumers might not find the utility of a long-range BEV to be substantially limited by trip distance. Some consumers might find that although a limited-range BEV might meet their average travel needs, it does not meet their needs to make the occasional long trip. A high frequency of those “inconvenient days” might greatly dissuade a consumer from purchasing a limited-range BEV. However, if consumers have multiple options for making longer trips, such as public transportation or a second vehicle, they might find that a limited-range BEV best meets their routine needs. PHEVs can accommodate all possible trip lengths with easy refueling, but they sacrifice electric miles for gasoline-fueled miles on longer trips. Average or routine travel needs, such as a commute, might also affect the PHEV range that a consumer might choose because matching PHEV range to average or routine use might improve the consumer value proposition. This discussion assumes that consumers understand their needs and the ability of various types of vehicles to meet those needs. Later, this chapter discusses misconceptions and gaps in knowledge about PEVs that lead to consumer misperceptions of range and vehicle utility, a barrier to PEV deployment.

Finding: Although there is substantial variability in vehicle use, average daily travel or other routine use provides a metric that can help evaluate the utility of a PEV.

Finding: Aside from average or routine use, many consumers make a small number of long-distance trips that might weigh heavily in their vehicle purchase decision.

Changing Landscape of Vehicle Ownership and Use: Implications for Adoption and Diffusion of Vehicles

Social and demographic changes are affecting the amount that people drive and the demand for new vehicles; these changes have implications for PEV sales and their use. Vehicle miles traveled (VMT) per capita generally increased from 1960 to 2007, outpacing growth in gross domestic product per capita. After 2007, VMT peaked, and VMT per capita began to decline as unemployment and gasoline prices rose, resulting in fewer commuters, fewer driving vacations, and more attention to the cost of fuel (FHWA 2012a; U.S. Census Bureau 2013a; Zmud et al. 2014). A 2014 report from the Transportation Research Board identified an aging and more ethnically diverse population, along with changing patterns in the workforce, urban living, household formation, views on environmentalism, and use of digital technology, which are affecting total and per capita VMT (Zmud et al. 2014). Although VMT is on the rise again, it is still below 2007 levels (FHWA 2014) and is projected to grow at an average annual rate of only 0.9 percent between 2012 and 2040 (EIA 2014a).

The demand for new vehicles also appears to be changing. First, the demand for new vehicles has decreased. Americans buy new vehicles every 6-8 years on average, as compared with every 3-4 years before the recession (Le-Beau 2012). Related research from J.D. Power (Henry 2012) shows that the average trade-in vehicle at dealerships is now 6.5 years old, 1 year older than the average in 2007. In contrast to almost all products, vehicles have a robust secondary (used) market that is larger than the new market; in fact, two-thirds of all U.S. vehicle purchases are for used vehicles (35.7 million in 2013) (Edmunds 2013). Those data have implications for vehicle purchases generally and PEV purchases specifically. Given the length of time between purchases, product options will have changed substantially, particularly because of model and technology changes, and what the consumer might want or need in a new model might have changed substantially. Thus, the consumer likely will undertake a lengthy and exhaustive process before purchase to research new options on the market; that research could take as long as several weeks or months and involve many hours of online research before even visiting dealerships (Darvish 2013). The decreased demand for new vehicles and the lengthy research process will certainly affect the adoption and diffusion rates for PEVs.

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

Second, the number of households without a vehicle has increased nearly every year since 2005; it was 8.87 percent in 2005 and 9.22 percent in 2012 (U.S. Census Bureau 2013a; Sivak 2014). Fewer vehicle-owning households might mean fewer households in the market for PEVs. The percentage of households without a vehicle also varies widely by geographical area. New York City, Washington D.C., Boston, Philadelphia, San Francisco, Baltimore, Chicago, and Detroit all have more than 25 percent of households without a vehicle (Sivak 2014). The geographic variation will affect where PEVs sell well.

Another factor that is changing is household formation. In 2000, 68.1 percent of households were defined as “family” (married couples with children, married couples without children, single parents with children, or other family). In 2010, that estimate decreased to 66.4 percent because single-person households increased from 25.8 percent to 26.7 percent (U.S. Census Bureau 2013a). As single-person households and urbanization increase, charging vehicles at home could become even more complicated as people move into apartments and multifamily dwellings and away from single-family homes that have garages or dedicated parking. As urbanization continues to rise, people might use transportation modes other than the traditional ICE vehicles. Although urban dwellers tend to log fewer VMTs (a characteristic favorable to PEV ownership), they might face challenges in finding a reliable and regular place to plug in and recharge in a city.

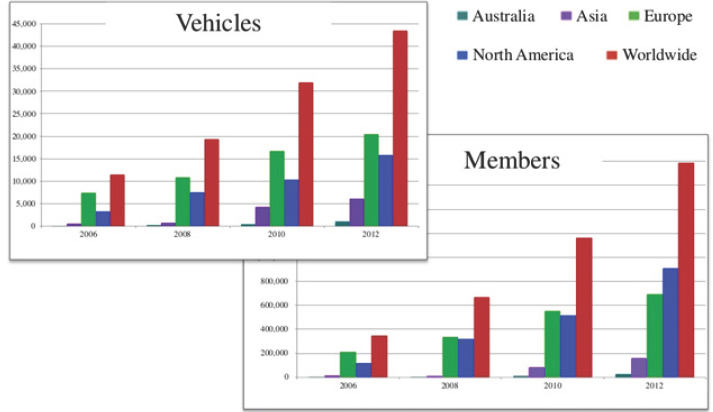

The societal changes noted are influencing the growth of alternative transportation methods, such as on-demand transport services (for example, Uber and Lyft) and car-sharing programs (for example, Car2Go and Zipcar). According to Susan Shaheen and Adam Cohen (2013), there are about 850,000 car-sharing members and 15,000 vehicles in North America (see Figure 3-5). Frost and Sullivan estimate in their optimistic scenario that up to 7 million members and 155,000 vehicles could be part of car sharing by 2020 (Brook 2014). Given that car sharing and on-demand services are growing and tailoring their services to city living, urban consumers are becoming reluctant to assume the responsibility and expense of a vehicle.

Car sharing could be a win or a loss for PEVs, depending on whether the programs use PEVs. If they do, they would provide ways for drivers outside the new-vehicle market to use PEVs. However, if potential PEV buyers chose to use car sharing and car-sharing programs use only ICE vehicles, PEV sales could be hurt and fewer miles electrified. Carsharing programs are discussed further later in this chapter.

Finding: Demographics, values, and lifestyles affect not only vehicle preferences but also the practicality of a given PEV for a given individual. Different market solutions will be needed for different market categories and segments.

FIGURE 3-5 Worldwide growth of car sharing in terms of vehicles and members.SOURCE: Shaheen and Cohen (2013), Transportation Sustainability Research Center, University of California at Berkeley.

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

| Factor | Description |

Relative advantage

|

The buyer’s perceived benefits of adoption (such as fuel savings) relative to the price paid (PEVs are expensive relative to ICE vehicles) and the nonmonetary costs (such as concerns about battery life, charging infrastructure, resale value, and vehicle range if a limited-range BEV).

|

Complexity

|

Difficulty of using the new product. For example, what is involved in charging at home, at work, or at public stations? Are permits required for at-home installation? Is membership needed for a charging network? How much will the electricity to fuel the vehicle cost, and how is that cost calculated?

|

Compatibility

|

How well does the new technology fit into the buyer’s lifestyle? For example, is the range of a limited-range BEV adequate?

|

Consumer concerns about standards, for example, different plug types and charging networks with different communications protocols and payment methods; mainstream consumers take a wait-and-see attitude to avoid purchasing the wrong product that does not become the dominant design.

| |

Trial-ability

|

How easy is it for a potential customer to try the new technology? A typical test-drive for a PEV can demonstrate its acceleration speed and drivability but does not allow the buyer to experience charging or to resolve other concerns that inhibit purchase of a PEV.

|

Observability

|

How observable are the benefits of the new purchase to the consumer, such as fuel savings relative to electricity costs; convenience of charging at home and not having to go to a gasoline station; and quiet driving experience.

|

How observable are the new technology and its benefits to other consumers; for example, seeing neighbors or co-workers drive a PEV or seeing PEVs plugged in at a public location hastens diffusion, much like iconic white ear buds and wires were highly visible symbols of Apple products.

|

NOTE: BEV, battery electric vehicle; ICE, internal-combustion engine; PEV, plug-in electric vehicle.

SOURCE: Adapted from Mohr et al. (2010).

Insights into strategies to diffuse new vehicle technologies beyond early adopters can be gleaned from industry studies on what consumers consider when they make a purchase and by examining general factors that affect adoption and diffusion of new technologies (Rogers 2003). Five factors typically affect the rates of adoption and diffusion for innovative products; these factors are shown in Table 3-4, which also provides implications specific to PEV deployment.

As noted earlier, the characteristics and buying motivations differ between categories of consumers. The characteristics of PEV owners to date are consistent with those of the early adopters. Because mainstream adopters (early and late majority categories combined) comprise the bulk of the purchases for any new technology (Rogers 2003), understanding their purchase motivations is critically important to increasing PEV deployment.

The top five reasons consumers give for their vehicle purchase choices generally (not specific to PEVs) are reliability, durability, quality of workmanship, value for the money, and manufacturer’s reputation (Strategic Vision 2013). Although often assumed to be a key influential factor in vehicle purchases, fuel economy is a primary consideration for 45 percent of consumers (compared with reliability, a primary consideration for 68 percent of consumers). In fact, fuel economy ranked 11 of 54 reasons on the basis of Strategic Vision’s May 2013 survey results. Interestingly, the average gasoline price per gallon was $4.02 at the time of the survey, and yet consumers still ranked such features as seating comfort above fuel economy as a purchase reason. Just 5 percent of U.S. consumers who purchased a vehicle responded that they were willing to pay more for an environmentally friendly vehicle (Strategic Vision 2013). Additional survey data from “rejecters” (people who considered buying a PEV but chose not to buy one) reveal consumer concerns about the reliability of the technology and the durability of the battery (Strategic Vision 2013). Those data suggest that consumers appear to use traditional criteria (reliability and durability) in their PEV evaluations and that PEVs today must compare effectively with ICE vehicles on traditional criteria to be competitive.

Egbue and Long (2012) conducted a study to explore concerns about PEVs specifically. Interestingly, in their sample of respondents (a population of faculty, staff, and students from a technically oriented university), battery range was the biggest concern expressed about PEVs, followed by the cost differential of PEVs compared with ICE vehicles. Battery range is not a question that is asked in typical vehicle industry research studies.4 Corroborating the results of

_____________

4 Business experts note several caveats in conducting and interpreting consumer research on new technologies (Leonard-Barton et al. 1995; Rayport and Leonard-Barton 1997; Seybold 2001; McQuarrie 2008). First, consumers necessarily are constrained in their responses by their knowledge of and familiarity with a given technology. Although they provide answers to research questions, the validity of their responses can be suspect. Moreover, the nature of the research protocols is similarly constrained by the known

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

the Strategic Vision study above, Egbue and Long (2012) similarly found that environmental considerations carry less weight in the purchase decision for PEVs than battery range and cost. Their study further suggests that even with incentives to subsidize the cost of PEVs, penetration rates are likely to remain low if consumers have low confidence in the technology.

Despite the fact that 55 percent of people shopping for a vehicle have “favorable” or “very favorable” impressions of PEVs (versus 62 percent in 2009) (Pike Research 2012), the purchase rates are still low.5 Importantly, consumers make decisions on the basis of their perceptions rather than factual data. Astute marketers realize that consumer perceptions form the basis of their reality—even if their perceptions are factually inaccurate. Although objectively, PEVs might exhibit a lower total cost of ownership than ICE vehicles, whether consumers actually compute a total cost of ownership in making vehicle purchase decisions is not apparent.6 Ingram (2013) states that 75 percent of people in 21 of the largest cities in the United States were unaware of cost savings and reductions in maintenance costs of PEVs. In fact, even for high-involvement purchase decisions, in which the assumption of a “rational consumer” is often made, psychosocial factors can be more important than rational considerations.

In addition to the price differential between PEVs and conventional vehicles and the range concerns for limited-range BEVs, the committee identified several additional barriers to PEV purchases—most of which are highly interrelated—that affect consumer perceptions and their decision process and ultimately (negatively) their purchase decisions. They include the limited variety and availability of PEVs; misunderstandings concerning range of PEVs; difficulties in understanding electricity consumption, calculating fuel costs, and determining charging infrastructure needs; complexities of installing home charging; difficulties in determining the “greenness” of the vehicle; lack of information on incentives; and lack of knowledge of unique PEV benefits. Those barriers are discussed briefly in the following sections.

Limited Variety and Availability of Plug-in Electric Vehicles

Consumers are accustomed to a dizzying array of ICE vehicle models and styles available from more than a dozen manufacturers. They include performance sports cars, mid-sized passenger cars, sport utility vehicles, crossovers, luxury sedans, compact and subcompact economy cars, sporty compacts, pickup trucks, minivans, and full-sized vans. Because consumers have a wide variety of needs and motivations, a wide array of PEV makes and models are needed to satisfy them. The rather limited choice of PEVs could slow market development.

Further complicating the rather limited variety of PEVs on the market is the fact that not all PEVs are available for sale in all states. Two main considerations affect vehicle availability. One is the availability of PEVs to the dealers, which is dictated by the vehicle manufacturers. Given the questionable profit margins (Lutz 2012; Voelcker 2013a; Loveday 2013b), some vehicle manufacturers might not be motivated to offer PEVs for sale in all 50 states. The other consideration is the availability of PEVs to customers—specifically, the number of dealers in a given area actually stocking the vehicle and the number of vehicles on the lot. PEV availability is highly variable by dealer and by location. Lack of availability and the limited diversity of PEV options are barriers to consumer adoption.

Range of Plug-in Electric Vehicles

Range anxiety refers to the fear of running out of charge and being stranded. The driver’s experience of range anxiety can be mild or strong and depends on the vehicle range, charging routines, and driving patterns (Frank et al. 2011). As discussed in Chapter 2, range limitation should be an issue only for limited-range BEVs. Yet, data collected from people who considered a PEV but did not buy one (rejecter data) reveal inaccurate perceptions about PEV range. For example, some buyers who considered the Chevrolet Volt did not buy it because it “lacked range,” despite the fact that the Volt’s onboard ICE gives the vehicle a range similar to that of a conventional vehicle. Specifically, after its 38 miles of all-electric range are depleted, it offers another 344 miles on gasoline. Such observations show that a lack of familiarity with PEVs poses a barrier to vehicle deployment; this negative effect is corroborated by the modeling work of Lim et al. (2014), who found that range concerns, as well as concerns over unknown resale value, inhibit mass adoption of PEVs.

Understanding Electricity Consumption

Drivers of ICE vehicles are accustomed to fueling with gasoline and understand how much range they have left and where gasoline stations are located relative to that range. PEV drivers, however, face a new experience—fueling with electricity—and will need to understand the interaction be-

_____________

and familiar. When replicating vehicle surveys to assess PEVs, the surveys do not include questions to assess consumer knowledge of and preference for charging infrastructure, range, and other relevant factors. As a result of those and other limitations, innovation experts recommend alternative methods of market research to complement traditional surveys and focus groups. 3M, Intel, HP, and other companies known for their culture of innovation rely on a variety of alternative research protocols, many of them more observational in nature, to recognize such limitations.

5 As a point of reference, the same survey showed 61 percent of consumers have “a favorable or very favorable” impression of HEVs that have sales of about 3-3.5 percent of new passenger vehicle sales.

6 Despite the lack of information, Eppstein et al. (2011) found in a simulation model that making available estimates of lifetime fuel costs associated with different vehicle types could enhance market penetration substantially. That possibility is supported by marketing in Japan, where at least one PEV manufacturer is actively using marketing messaging with information on total cost of ownership.

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

tween several factors, including the storage capacity of the batteries, access to charging infrastructure, and driving behavior. The amount of stored electricity is measured and then communicated through dashboard displays that provide an estimate of the remaining range of the battery, a measurement that not only is new but that can also be imprecise. PEV owners will experience consuming the electric energy (depleting the battery) quickly or slowly, depending on driving speed (fast or slow), conditions (such as ambient air temperature and steepness of the road grade), and driving style of the driver (light-footed or heavy-footed) (Turrentine et al. 2011). A PEV on a cold day can consume its stored electric energy quickly because some portion of that energy goes to heat the vehicle interior; hence, drivers might see the battery energy on the dashboard display drop rapidly. For example, the range of a Nissan Leaf is 84 miles on the EPA test cycle, but if the owner drives 90 percent of his or her miles at speeds above 70 mph and lives in a cold climate, the range could be as low as 50 miles. Thus, to feel comfortable purchasing a PEV, consumers generally must understand PEV fuel consumption.

Calculating Fuel Costs

Determining electricity costs relative to gasoline costs is yet another factor that affects consumer perceptions and purchase decisions.7Box 3-1shows how electricity cost could be calculated. The committee was not able to find data on consumer perceptions of electricity costs compared with gasoline costs. However, the calculations in Box 3-1 are likely complex enough to be overwhelming for a typical mainstream consumer and highlight the difficulty that consumers face in computing fuel costs, particularly compared with those for ICE vehicles. In fact, few consumers are likely to go into this level of detail to understand fuel costs when considering a vehicle purchase. The unknown costs represent yet another source of doubt and are therefore another barrier.

Overall, the data indicate that energy costs for PEVs are likely to be lower, even one-half of gasoline costs. Enrolling in special rate plans, taking advantage of nighttime prices in some markets, accessing some free electricity at workplaces, and relying on public charging could save PEV drivers even more. It is important to note that PEV drivers experience substantial variation and complexity in energy costs across regions. Even within a given region, there is much local variation because of local rates and special PEV rates offered by the thousands of electric companies in the United States, differences in prices charged at public charging stations, and in some cases free charging at public and work locations.

Determining Charging Infrastructure Needs

The charging infrastructure is a new part of the vehicle ecosystem that customers must navigate. Potential PEV purchasers need to know what type of charging infrastructure they will need, how to get it installed at home, how to find charging stations when needed, and how to subscribe to or pay for access to the charging stations. Those issues must be considered by potential PEV customers when they consider purchasing a PEV.

Unlike ICE vehicles, for which public fueling stations are the standard, PEVs may be fueled with electricity at home, at workplaces, or at public charging stations (see Chapter 5). In fact, early adopters have primarily satisfied their charging needs at home, and the majority of mainstream PEV adopters are also likely to find home charging to be most convenient. The paradigm for fueling PEVs at the owner’s home is a fact not appreciated by many unfamiliar with PEVs, including many policy makers and presumably many potential PEV customers who believe that public charging stations are needed.

Although home charging has been the primary method of refueling, public charging does have an important role to play. The PEV-driver experience is shaped by the presence (availability and visibility) of the charging network in his or her region, and a perception of a lack of public charging infrastructure might hinder PEV deployment. For example, the United States has over 100,000 gasoline stations compared with about 8,400 public charging stations (U.S. Census Bureau 2012). Japan has recognized the importance of public visibility and access to charging and has instituted a major initiative to build an extensive charging infrastructure to instill range confidence and ensure a safety net for limited-range BEV drivers (METI 2010). Drivers of all types of PEVs can use their mobile phones or dashboard displays to navigate and find fueling stations. Apps for PEV owners to monitor their state of charge and to find fueling stations compatible with their vehicles might be particularly important to mitigate consumer concerns about location of fueling stations.

The extent to which customers understand charging infrastructure requirements and needs is unknown; however, it is reasonable to speculate that these considerations are new, and perhaps surprising, to mainstream consumers. The committee notes that the effect of public-charging availability on PEV deployment is not well understood (Lim et al. 2014).

Installing Home Charging

Depending on regional variations, BEV and PHEV buyers might need to choose, acquire, permit, finance, and install a charger for their primary parking location even before purchasing the vehicle. The decision process will require the buyer to understand the differences in charging technologies and possibly to answer the following questions: Do they want or need AC level 1 or level 2 charging? Are upgrades of

_____________

7 Much of existing data about PEV driver behavior with respect to electricity prices are shaped by the high income of the initial buyers who are not as sensitive to gasoline or electricity costs as later adopters are likely to be.

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

People shopping for a vehicle face difficulties in calculating fuel costs per mile, especially if they are trying to compare the fuel costs of vehicles operating on different fuels, including BEVs, PHEVs, HEVs, and ICE vehicles. A typical customer’s thought process might proceed as follows:

Possible Cost Calculation for a PEV

Take as an example the five-passenger Nissan Leaf, which gets 3 or 4 miles per kilowatt-hour, depending on speed and the heating or cooling needs of the cabin interior. Assume that the average price of residential electricity in the United States is 12.5 cents per kilowatt-hour; this number is based on a range in the United States of 10 to 15 cents per kilowatt-hour (EIA 2014b), and this in turn translates to 3 to 5 cents per mile. On average, therefore, a Leaf owner who charges at home will pay about 4 cents per mile for electricity (these numbers average local taxes on electricity bills).

Possible Cost Calculation for an ICE Vehicle or an HEV

Gasoline in the United States in August 2014 cost on average about $3.60 per gallon (regional averages ranged from $3.35 in the Gulf Coast region to $3.91 in the West Coast region) (EIA 2014c). An especially efficient HEV, the Prius, gets about 50 miles per gallon. Average ICE passenger vehicles have a fuel economy of 35 mpg. Thus, the Prius would have cost 7.2 cents per mile, and the average passenger vehicle would have cost about 10 cents per mile in the United States in August 2014.

Therefore, in most places in August 2014, BEVs and PHEVs operating in electric mode on stored electricity from the grid cost less than one-half as much per mile as a comparable-sized gasoline vehicle. Specifically, driving 10,000 miles in a gasoline-fueled compact vehicle would have cost around $1,000 for gasoline in 2014; a comparable-sized BEV would have cost less than $500 at that time.

Additional Considerations

- The cost of electricity for a PHEV will vary greatly depending on driving patterns, the charging frequency, and the battery capacity.

- Many PEV drivers might charge away from home, where prices vary. Some PEV drivers might be able to maximize their savings by charging for free at work and getting low off-peak or special PEV rates from their utility.

- Some places, especially California, have tiered rates to discourage high consumption, or time-of-use rates to shift consumption peaks. Those pricing structures can make electricity rates vary for an individual household by time of day, by total monthly consumption, or by climate zone in which the house is located.

- The cost of gasoline can also vary substantially, and that variation complicates the calculation of total fuel costs for PHEV drivers.

household circuits, panels, and even transformers required? How much will the changes cost? What permitting processes, fees, and timing are involved? Will installing a charger require financing (most states require financing of the charger to be separate from that of the vehicle)? How much will the extra cable for 240 V (level 2 charging) cost?8

Whether the vehicle is leased or purchased might have an effect on the home-charging decision; people who lease might be less willing to commit to the expense and effort of installing home charging. In other cases, installation concerns might be alleviated if PEV owners can use an existing outlet in their garage. The charging concerns for the 46 percent of new PEV buyers who do not have access to home-charging because they park on the street or live in a multiunit dwelling will be different, but they loom large nonetheless (Axsen and Kurani 2009). Barriers to home-based charging for that market segment are discussed in Chapter 5.

To help mainstream PEV consumers navigate their home-charging needs, some vehicle manufacturers have formed partnerships to streamline the purchase and installation of home chargers. Three examples of partnerships (listed below) are cited in the Federal Highway Administration action plan (FHWA 2012b), but one has been discontinued and another has been reworked.

- Ford and Best Buy. Ford initially partnered with Best Buy to offer buyers an integrated process for purchasing a vehicle and installing a home charger; Best Buy’s Geek Squad and third-party electrical contractors provided installation services. The charging equipment provided by Leviton could be removed, so that owners could easily take the charger with them when they moved. Ford estimated a cost of around $1,500 for the charging equipment and installation services. The program ended in 2013 when Ford partnered with AeroVironment (Motavalli 2013).

- General Motors and SPX. General Motors initially offered an AC level 2 home-charging system through a partnership with SPX. The equipment costs were $490; installation costs varied depending on the existing home

_____________

8 The 240 V cables are different from the 110 V cables that come with the vehicle and represent an additional customer expense.

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

- wiring but were typically about $1,500 (GM Authority 2010). General Motors appears to have discontinued its offer for an AC level 2 charging system because the Chevrolet Volt can recharge overnight using an AC level 1 charger.

- Nissan and AeroVironment. For the Leaf, Nissan teamed with AeroVironment to provide home charging; Nissan estimates that a private contractor charges about $2,000 on average for a typical installation.

Charging decisions are unique to PEVs and can be overwhelming. Indeed, until the purchase and use process is simpler—for example, a dealer helps the customer manage the whole process—mainstream consumers simply might revert to the more familiar purchase of an ICE vehicle that does not have these added complications (Moore 2014).

Greenness of Plug-in Electric Vehicles

Perceived favorable environmental impact (the greenness) of PEVs motivated some early adopters to purchase PEVs, although environmental impacts appear to be less of a motivator for mainstream market consumers given that just 5 percent of U.S. vehicle purchasers stated a willingness to pay more for an environmentally friendly vehicle (Strategic Vision 2013). Others also find that the impact of a green product on consumer purchases is usually a third trigger, behind price and quality (Esty and Winston 2009). Still, consumers might want to know about the greenness of a PEV—if not for themselves, then when friends, family, and colleagues inquire.

Consumer might ask the following questions: Does driving a PEV actually benefit the environment? Are greenhouse gas emissions and local pollutants decreased if I drive a PEV? Is my electric company a low- or high-carbon emitter? Is my electric company lowering its carbon emissions over time? Similar to computing electricity costs, assessing the greenness of a vehicle is complicated;9 it includes not only the greenness of the electricity supply used to charge the vehicle but also issues related to how batteries will be disposed of and their contribution to environmental degradation (see Chapter 4 for a discussion of battery recycling). Greenness can be calculated on a well-to-wheels basis, which counts greenhouse gas emissions from a vehicle’s tailpipe (tank-to-wheels) and upstream emissions from the energy source used to power a vehicle (well-to-tank).10 Although the factual details about the cleanness of the electric grid (see Chapter 1) might not be widely known, consumer uncertainty about how green PEVs actually are might cause customers to balk at purchasing one.

Lack of Information on Incentives

As discussed in Chapters 2 and 7, the prices of PEVs are higher than those of comparable ICE vehicles. However, various financial incentives for consumers can help offset the difference. PEVs can also have nonfinancial incentives, such as access to high-occupancy-vehicle lanes (see Chapter 7for an extensive discussion of incentives). Consumer awareness and perceptions of incentives influence their purchase decisions. In Norway and the Netherlands, for example, PEVs are particularly popular because people are aware of and want to take advantage of the generous incentives. In the United States, however, a study by Indiana University shows that 95 percent of the U.S. population in the 21 largest cities is unaware of such incentives (Ingram 2013). A further complication is that federal, state, and municipal incentives are often designed to start and stop at certain times or when certain sales volumes have been achieved. The variability and inconsistency of incentives contribute to customer confusion in evaluating and purchasing PEVs.

One study suggests that the effectiveness of PEV incentives could be enhanced through greater consumer awareness (Krause et al. 2013). Dealers could be a source of information about incentives but are unlikely to have all the necessary information, as discussed below. Moreover, dealers might not want to provide information on incentives for fear of being held accountable if they provide inaccurate information (Cahill et al. 2014). Several Internet sources provide information on incentives, but the degree to which consumers are aware of and use them is unknown.

Lack of Knowledge about the Benefits of Plug-in Electric Vehicles

PEV ownership offers benefits that are familiar to and valued by their drivers but are probably unfamiliar to mainstream consumers. For example, people discover on driving PEVs that they are “peppy” and provide smooth acceleration; moreover, they are quiet (Cahill et al. 2014). In addition, PHEVs do not need oil changes as frequently as ICE vehicles, and BEVs do not require any oil changes (Voelcker 2013b, 2014). Furthermore, regenerative braking and energy recovery, which is novel to many new PEV drivers, provides a unique sensation. Whether engineered as part of the traditional braking system (as in the Toyota Prius) or integrated into the acceleration system (as in the BMW i3 and Tesla Model S), or both, regenerative braking creates a unique driving experience. In contrast to systems that capture kinetic energy when the driver begins to brake, regenerative braking integrated into the acceleration system begins to slow the vehicle and capture energy the moment drivers remove their foot from the gasoline pedal. Some drivers perceive the automatic braking as an advantage, especially in heavy traffic.

Thus, PEVs provide a driving experience that is different from that of a traditional ICE vehicle. Such differences

_____________

9 Take, for example, the greenness of the electric grid. Depending on whether the power plants in a given area produce electricity from coal, nuclear, wind, hydropower, or other energy source, the greenness can vary greatly.

10 A more complete analysis of vehicle greenness is a life-cycle assessment that, in addition to the well-to-wheels assessment, takes into account environmental impacts of vehicle production, vehicle use, and disposal of the vehicle at the end of its life.

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

| Vehicle Technology | Vehicle Charging | Other Concerns |

| Questions PEV Customers Might Have | ||

Why are PEVs more expensive than conventional vehicles?

What is the battery range?

How many years will the battery last?

Do I need to replace it?

Is there a risk of fire?

Does the vehicle have sufficient power to drive on the highway?

What will be the resale value?

|

Where can I charge the vehicle?

Can I charge it at home?

Do I need a special plug?

How much will the electricity cost?

How long does it take to charge?

|

What happens if I become stranded because I run out of charge?

How green is a particular PEV?

Do the batteries end up in landfills?

|

| Questions Customers Might Not Know to Ask | ||

How much of my battery range will be sacrificed to interior heating and cooling in cold or hot temperatures?

Can my regular repair shop perform maintenance and repair work on the vehicle?

How does regenerative braking work?

Will my battery degrade over time if I use DC fast charging?

What are the savings in maintenance and fuel relative to the purchase price of the vehicle?

|

Where do I charge if I do not have a garage?

Are there permitting fees to get a dedicated charger installed in my home?

Does my state offer a rebate or incentive to install charging equipment in my home?

If I want AC level 2 charging, do I need additional equipment, and how much will it cost?

Do I need to inform my utility if I purchase a PEV?

Do my rates for charging differ depending on the time of day?

If I belong to a charging network, can I use chargers from other networks?

How do I find a charging location?

Can I reserve a charging location?

What if the charger I need to use is being blocked by another vehicle?

|

How do I file for my tax credit?

Does my state offer a tax credit?

Do I get free parking?

Do I get access to a high-occupancy-vehicle lane with a PEV?

Does my employer offer charging at work?

Because the car is so quiet, how do I know if it is running?

|

| Questions Friends, Neighbors, and Even Strangers Might Ask | ||

Did my tax dollars subsidize the purchase of your PEV?

|

Do these vehicles put excessive demands on the electric grid?

|

Why do people with PEVs get the most convenient parking spots?

Do you pay any fuel fees for highway funds or road taxes?

|

might appeal more to early adopters than to mainstream consumers, but mainstream consumers will never know whether PEVs meet or even exceed their expectations unless they can drive one, making the test-drive a critically important experience, as discussed later in this chapter.

Summary of Major Perceptual Barriers

From the committee’s perspective, the factors discussed above pose major barriers to consumer adoption of PEVs. Confusion continues to loom large in the consumer purchase decision for PEVs. Table 3-5 identifies questions that customers might have when contemplating a PEV purchase. Some questions—Will my battery catch fire? How do I change my battery?—might seem nonsensical to a current PEV owner, but they are questions that consumers have asked and demonstrate the extent of misinformation and the nature of the perceptual barriers that must be overcome before PEV deployment becomes widespread.

Uncertainty and perceived risk plague consumer willingness to purchase innovative products, particularly expensive, long-lived ones, such as vehicles; consumers instead revert to the known and familiar (Mohr et al. 2006). Until they are sufficiently informed and educated, they will likely continue to prefer the relative safety, security, and familiarity of an ICE vehicle. Therefore, mainstream adopters require additional encouragement, information, and incentives to overcome the barriers identified.

Finding: Lack of consumer awareness and knowledge about PEV offerings, incentives, and features is a barrier to the mainstream adoption of PEVs.

Finding: The many perceptual factors that contribute to consumer uncertainty and doubt about the wisdom of a PEV purchase combine with price and range concerns to negatively affect PEV purchases.

A well-known aspect of the vehicle-purchase process entails visits to various dealerships for test-drives and purchase negotiations. Vehicle dealerships traditionally have offered

Suggested Citation: "3 Understanding the Customer Purchase and Market Development Process for Plug-in Electric Vehicles." Transportation Research Board and National Research Council. 2015. Overcoming Barriers to Deployment of Plug-in Electric Vehicles. Washington, DC: The National Academies Press. doi: 10.17226/21725.

×

many services to help with the complexity of the purchase process. In fact, in the early years of the automobile market, dealers supported Americans with their vehicle purchases by teaching them to drive and by providing financing, maintenance advice, and service to keep vehicles running. Accordingly, dealers have always played a critical role in the decision-making process of people purchasing a vehicle (Ingram 2014). Given that 56 percent of PEV buyers make over three visits to dealerships, which is twice the number made by non-PEV buyers (Cahill et al. 2014), vehicle dealerships could serve as an important source of information for potential PEV buyers.

Despite the importance of the consumer experience at the dealership, research on dealers and PEVs reveals systemic problems. A Center for Sustainable Energy survey of over 2,000 PEV buyers in California in December 2013 showed that 45 percent of those buyers were “very dissatisfied” and another 38 percent were “dissatisfied” with their purchase experience (Cahill et al. 2014). In the same survey, PEV buyers were asked “how valuable was it to have dealers knowledgeable about various topics.” The responses in Table 3-6 show that PEV buyers expect dealer salespeople to be informed about much more than just the vehicle characteristics. However, a Consumer Reports mystery shopper recently went to 85 dealerships in four states and found that salespeople were not very knowledgeable (Evarts 2014).

The dealer and salesperson motivation to sell PEVs varies. As noted in the committee’s interim report (NRC 2013b), salespeople take three times longer to close a PEV sale than an ICE vehicle sale—time for which they are not differentially compensated. Furthermore, because dealership revenues include charges for after-sales service and support and because PEV maintenance requirements are lower than those for ICE vehicles, that service revenue is missed. Moreover, sales staff at dealerships often turnover rapidly; thus, technically savvy sales staff who are knowledgeable about PEVs are not always available at a given dealer on a given day. Given such turnover, sales training on new products is not always a good investment for the dealership (Darvish 2013).

To address those issues, some dealers in California have hired PEV advocates to sell PEVs specifically. Rather than train the entire sales force, high-volume PEV dealerships have one or two PEV gurus. Moreover, some dealerships now separate floor (personal) sales from Internet sales, and in some situations, 100 percent of PEV sales come from Internet inquiries (UC Davis 2014).11 The PEV gurus usually are part of the Internet sales team for the dealer; social media are used to steer buyers to those individuals. Partially because dealership salespeople might lack the ability, time, or incentives to educate customers adequately about PEVs, Tesla decided to operate its own dedicated showrooms in which specially trained employees focus exclusively on educating customers about Tesla vehicle ownership. Tesla showrooms are typically styled like boutiques in high-traffic locations, such as a mall, much like Apple stores.

In addition to the paucity of knowledgeable salespeople, the Consumer Reports study (Evarts 2014) also found that dealers simply did not have PEVs in stock. Only 15 of 85 dealers in four states (California, New York, Maryland, and Oregon)12 had more than 10 PEVs on their lots; indeed, most dealers had only 1 or 2 PEVs on their lots. That finding is supported by a UC Davis study, which found that 65 percent of California dealerships had no PEVs for sale (UC Davis 2014).